2025 Inflation Outlook: High and could be higher

- 08 Enero 2025 (5 min read)

KEY POINTS

After disappearing from the investors’ risk radar a year ago, inflation is now back in focus with expectations of elevated price pressures throughout 2025. In our view, the key drivers include:

- Services Inflation: with strong demand in service sectors and ongoing labor market constraints, services inflation is expected to stay elevated and just gradually come off from current levels.

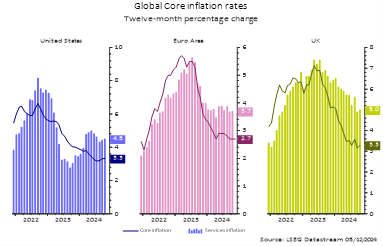

Figure 1: Global core and services inflation rate, % yoy

Source: LSEF DataStream 05/12/2024

- Increased fiscal support: governments globally signaled a ramp up in debt issuance for next year to underpin activity and consumption, and this is likely to sustain inflation in 2025.

Impact of Trumpnomics

President-elect Donald Trump’s proposed fiscal agenda has the potential to be unequivocally inflationary, reflecting increased government spending and tax reforms aimed at stimulating economic activity. Donald Trump has discussed the key economic themes for a second term: migration, tariffs, fiscal easing, and deregulation.

However, we consider tariffs and migration restriction to be supply shocks and fiscal easing to be a demand boost. We believe this is likely to see U.S. inflation reaccelerate, perhaps sharply, depending on scale and pace of tariffs. We forecast an eye catching 2.8% of inflation in 2025, well above market expectation.

In terms of growth, depending on financial market reaction, we expect U.S. activity to remain solid into 2025 – softening from a robust 2.8% expected for 2024 but likely to remain above trend at 2.3% for 2025. However, assuming broad implementation of Trump’s policies across 2026, we expect to see material headwinds to growth in 2026 to 1.5%

In other regions, the outlook is more nuanced

In the UK, for example, headline inflation is expected to average 2.5% in 2025, with additional price pressures stemming from tax adjustments outlined in the latest budget. However, the growth picture is set to remain sluggish as household spending remains subdued.

Finally, inflation in the euro bloc is forecast to undershoot the European Central Bank’s 2% target for much of 2025 and 2026, reflecting subdued wage growth and structural challenges. This outlook is already priced into markets, limiting surprises for investors.

Amid these dynamics, inflation breakevens remain depressed, particularly in the U.S. and the UK, offering potentially attractive tactical opportunities for inflation-conscious investors. However, one of our favorable approaches lie elsewhere in long real rates.

Investment opportunities: keep it real

As widely anticipated, G10 central banks pivoted to rate cuts in 2024, marking a notable shift from the aggressive monetary tightening of recent years. This easing cycle, aimed at countering growth headwinds and taming recession risks, came in response to declining short-term inflationary pressures. However, the broader market reaction highlighted a divergence in rate dynamics, particularly for long-term yields.

2024 was indeed a tale of two tenors: While central banks slashed short-term policy rates, long-term yields ended the year significantly higher, a development that caught many by surprise because of stubbornly high inflation. We expect the volatility in rates to remain until market participants have more clarity on the deployment of Donald Trump’s agenda, but this is likely to happen in the first months of the year.

However, with growth momentum expected to fade as fiscal policies lose steam, long-duration approaches in real rates present a potentially compelling opportunity. Real rates are in positive territory across all markets, and we believe this level remains on the restrictive side. As growth slows and inflation stabilizes, long real rate positions may be poised to perform.

The interplay of policy decisions, inflation expectations, and debt dynamics is shaping a complex investment landscape for 2025. While long-term rates defy traditional patterns, selective opportunities in breakevens and real rates could offer value. Investors may want to remain nimble, navigating the evolving economic environment with an eye on long-term growth and inflation trends, the variable that we expect to remain “higher for longer.”

Disclaimer

Risk Warning

Investment involves risk including the loss of capital.

The information has been established on the basis of data, projections, forecasts, anticipations and hypothesis which are subjective. This analysis and conclusions are the expression of an opinion, based on available data at a specific date. Due to the subjective aspect of these analyses, the effective evolution of the economic variables and values of the financial markets could be significantly different for the projections, forecast, anticipations and hypothesis which are communicated in this material.

Disclaimer

This document is being provided for informational purposes only. The information contained herein is confidential and is intended solely for the person to which it has been delivered. It may not be reproduced or transmitted, in whole or in part, by any means, to third parties without the prior consent of the AXA Investment Managers US, Inc. (the “Adviser”). This communication does not constitute on the part of AXA Investment Managers a solicitation or investment, legal or tax advice. Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

© 2025 AXA Investment Managers. All rights reserved.