Global factor views: Macroeconomic uncertainty leaves Quality in favour

- 25 Abril 2023 (7 min read)

Key points:

- Despite current market and macroeconomic challenges, markets are ahead year to date

- We believe a slow-growth, high-inflation backdrop argues in favour of Quality stocks

- We remain neutral towards Value and Low Volatility, and are negative on Momentum

Global economic activity has been relatively resilient, but cracks are beginning to show. The Federal Reserve expects a “mild recession” in the US later in 2023, brought on in part because of the banking sector turmoil, while Europe may also endure a contraction.

We presently forecast global GDP growth of 2.7% this year and next, down from 3.5% in 2022.1 While slower growth may well help ease inflationary pressures and most central banks are probably close to the peak of their tightening cycles, interest rate cuts are unlikely to occur anytime soon given how stubborn core inflation has been.

But despite the macroeconomic challenges, and March’s banking crisis, global markets have rallied. The MSCI World NR Index is up 9% year to date, as investor risk appetite was buoyed by China reopening and the downgrading of the likelihood of a hard landing for the US economy.2

Looking ahead, given market valuations are no longer cheap, earnings growth will be key to supporting 2023 returns. Bottom-up earnings per share growth and margin forecasts look optimistic given the slower macroeconomic, high-inflation backdrop.

These conditions increase the risk of negative earnings surprises and argue in favour of a focus on high-quality companies with profit moats - strong competitive advantages that can potentially help protect their profits.

Given current macro conditions we set out in detail our outlook for equity market factors below.

Quality: Positive

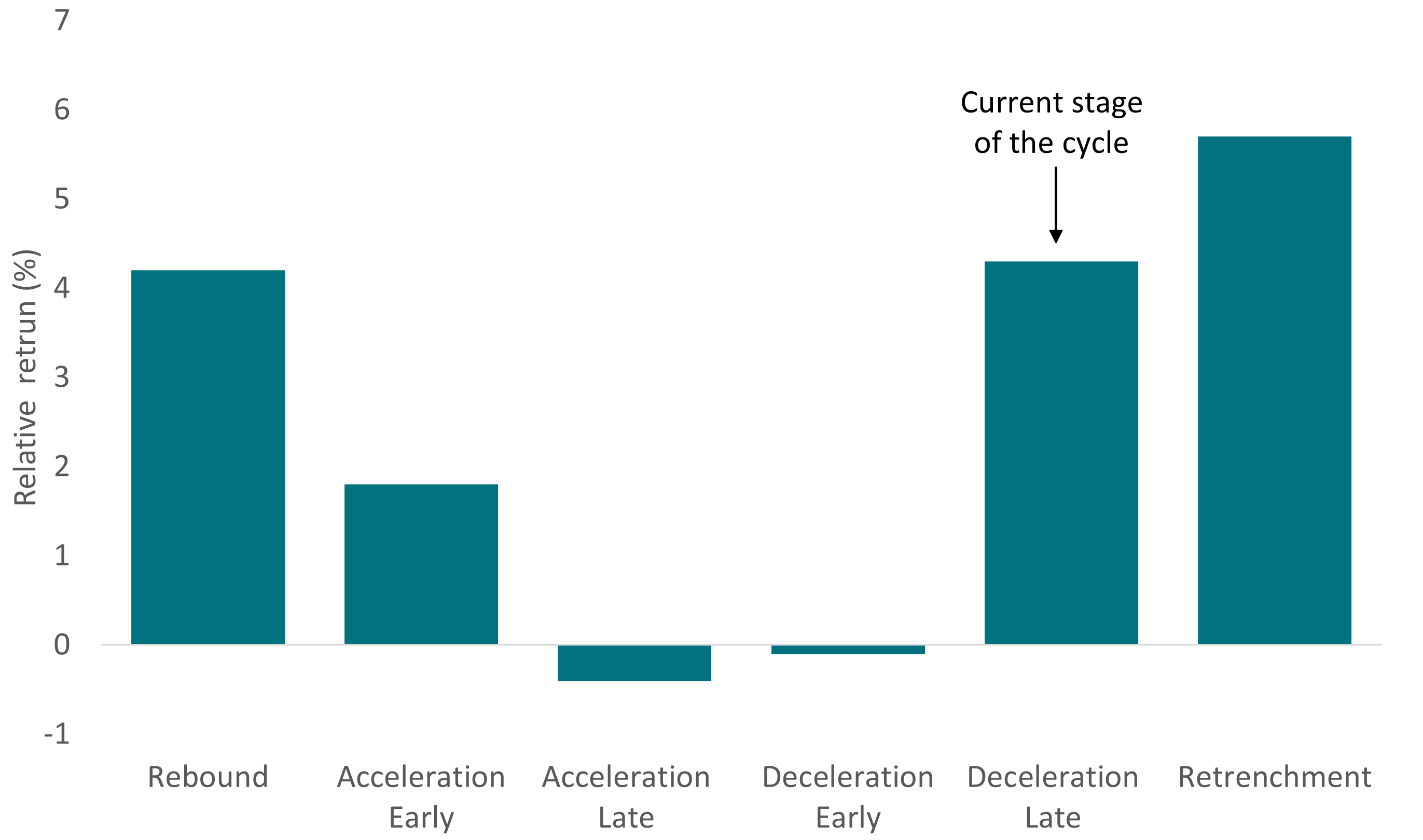

Quality – equities with more consistent earnings and typically less share price volatility – tends to outperform when macro momentum is weak or slowing and we remain positive on this factor (see Exhibit 1). Quality stocks should also benefit when interest rates are close to their peak, which should mean that the de-rating headwinds experienced by Quality-Growth is likely to be behind us.

In addition, a weak macroeconomic backdrop combined with optimistic earnings expectations increases the risk of negative earnings surprises, but high-quality companies should be less exposed to this. While macroeconomic and earnings views underpin our positive outlook, we would highlight that some Quality constituents look relatively expensive compared to historical levels, which argues in favour of an active approach.

Exhibit 1: Quality returns over stages of the economic cycle

Source: AXA IM EQI, ISM. Quality returns calculated by AXA IM EQI based on top quintile of ROE. Stage of economic cycle based on six-month rolling average of ISM New Orders: Rebound (increasing, below 46), Early Acceleration (increasing, 46-55), Late Acceleration (increasing, above 55), Early Deceleration (decreasing, above 55), Late Deceleration (decreasing, 55-46), Retrenchment (decreasing, below 46).

Value: Neutral

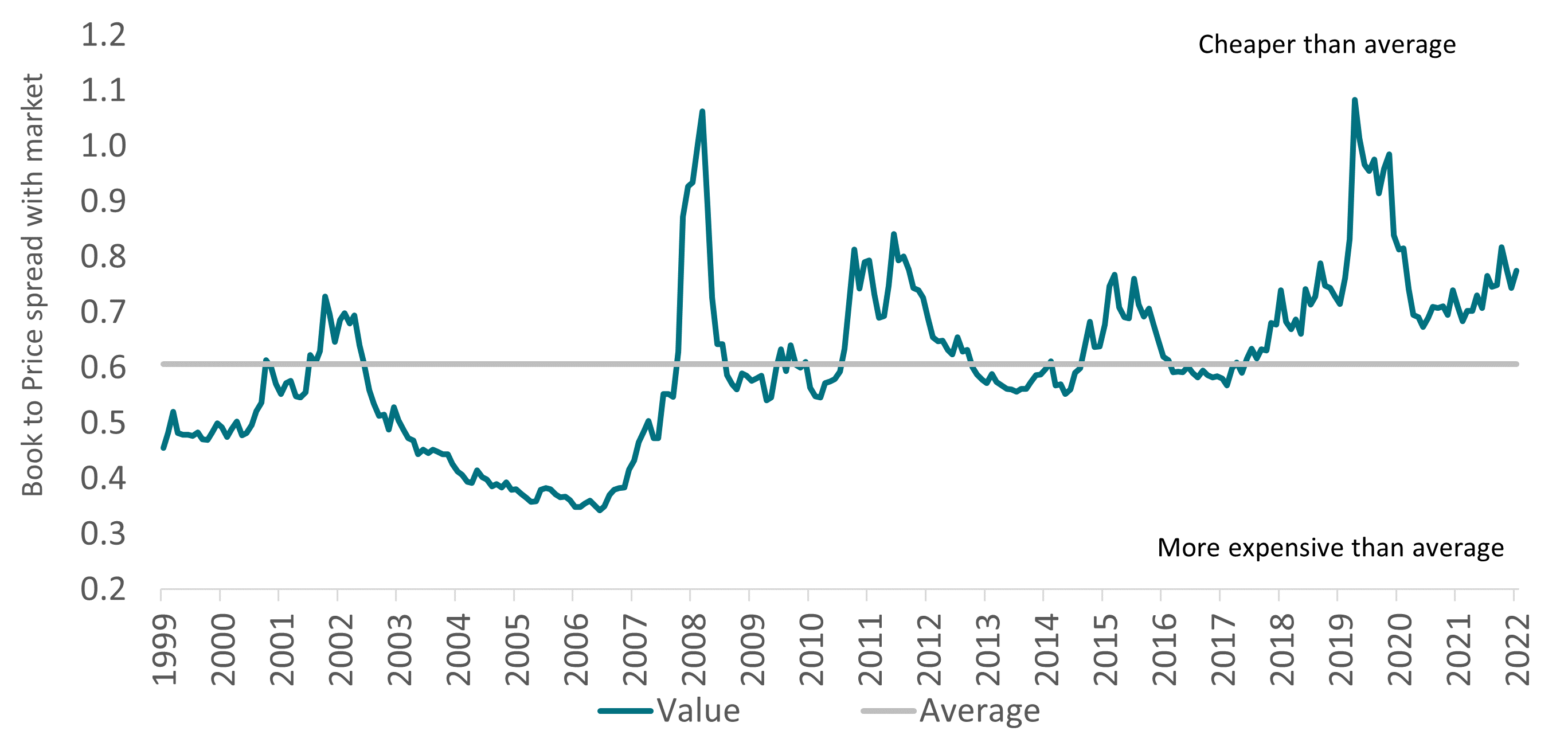

Value stocks - those which appear to be trading for less than their underlying worth – are currently cheaper than their historical average3 (see Exhibit 2). But despite this, we remain neutral towards the asset class, for two primary reasons. First, interest rate conditions may be more benign compared to this time last year, when the more hostile monetary tightening backdrop favoured Value over Growth, but rates are unlikely to retreat quickly from here. Second, slowing macroeconomic momentum is typically unfavourable for Value, generally because of its exposure to more cyclical areas of the market.

Exhibit 2: Value: Book-to-Price relative to market

Source: AXA IM EQI. Value calculated AXA IM EQI based on top quintile of Book to Price.

Momentum: Negative

Despite Momentum’s poor recent performance, our macro, valuation, and technical indicators for the factor remain unsupportive and we therefore stick to our negative view. With Momentum, the aim is to capture stocks which have had a positive price change relative to the market over the last 12 months, and presently it remains a popular, crowded trade. From a macro perspective slowing growth has not historically been supportive of price momentum. Its exposure to the energy sector, while down from where it was at the start of 2023, also remains a barrier; in the absence of a serious deterioration in geopolitics, the recent significant excess performance of energy is unlikely to persist, and this may weigh on the performance of Momentum. With market-wide 2023 earnings forecasts looking optimistic, our preferred measure of investor sentiment remains earnings revisions.

Low Volatility: Neutral

Slowing macroeconomic momentum is the key metric that continues to argue in favour of the defensive attributes of Low Volatility. But we remain neutral because forward valuations are not cheap and while we expect slower economic growth, we acknowledge there is a low probability of an entrenched recession.

- TWFyY2ggTW9udGhseSBJbnZlc3RtZW50IFN0cmF0ZWd5IHZpZXcgKGF4YS1pbS5jb20p

- QXMgYXQgMTMgQXByaWwgMjAyMy4gU291cmNlOiBGYWN0U2V0LCBpbiBVUyBkb2xsYXIgdGVybXM=

- QVhBIElNLCBJL0IvRS9TIGFzIGF0IDMxIE1hcmNoIDIwMjM=

Disclaimer

This document is for informational purposes only and does not constitute investment research or financial analysis relating to transactions in financial instruments as per MIF Directive (2014/65/EU), nor does it constitute on the part of AXA Investment Managers or its affiliated companies an offer to buy or sell any investments, products or services, and should not be considered as solicitation or investment, legal or tax advice, a recommendation for an investment strategy or a personalized recommendation to buy or sell securities.

Due to its simplification, this document is partial and opinions, estimates and forecasts herein are subjective and subject to change without notice. There is no guarantee forecasts made will come to pass. Data, figures, declarations, analysis, predictions and other information in this document is provided based on our state of knowledge at the time of creation of this document. Whilst every care is taken, no representation or warranty (including liability towards third parties), express or implied, is made as to the accuracy, reliability or completeness of the information contained herein. Reliance upon information in this material is at the sole discretion of the recipient. This material does not contain sufficient information to support an investment decision.

Issued in the UK by AXA Investment Managers UK Limited, which is authorised and regulated by the Financial Conduct Authority in the UK. Registered in England and Wales, No: 01431068. Registered Office: 22 Bishopsgate, London, EC2N 4BQ.

In other jurisdictions, this document is issued by AXA Investment Managers SA’s affiliates in those countries.

© 2023 AXA Investment Managers. All rights reserved