US investment grade credit bounces back from its nadir

KEY POINTS

In his 1974 children’s book, The Tiger’s Bones, the English poet Ted Hughes wrote that “Nothing is free. Everything has to be paid for.”1

Looking at the healthy state of the US corporate credit market today – the jewel in the crown of the global credit universe – one could be forgiven for forgetting about the heavy price paid by all fixed income assets to get to this point.2

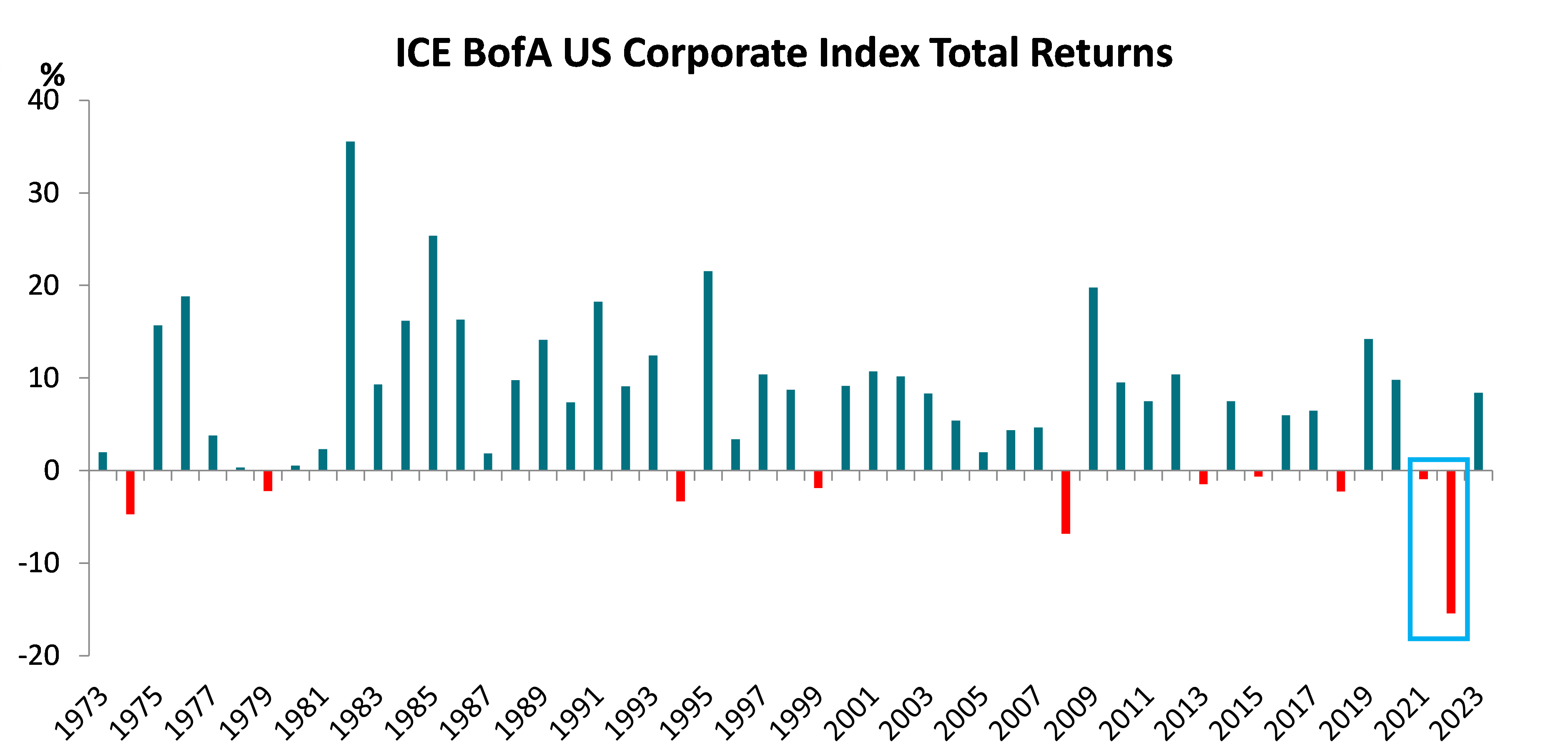

Today, parallels can be drawn between the time Hughes was writing in the mid-1970s and the impact of spiralling inflation on financial markets. The recent inflationary spike – to levels not witnessed since the 1970s – and the Fed's subsequent aggressive pace of policy tightening saw the ICE BofA US Corporate Index suffer consecutive negative return years in 2021 and 2022 for the first time since records began in 1973.

Source: ICE BofA as of December 31, 2023

However, as the chart above demonstrates, not only are negative years relatively rare in credit, but the market tends to bounce back following a downturn as coupons reset at higher levels, and income takes over once more in driving returns.

In a little over two years, the broad market’s average par-weighted coupon has risen by 58 basis points (bp), and we believe it will continue to rise significantly as more companies come to refinance old debt put in place during the post-global financial crisis years of low interest rates and low yields.3 According to JP Morgan, the average coupon of new investment grade (IG) issuers in the fourth quarter (Q4) of 2023 was 6.2%, well above the 10-year average of 3.6%.4

- Ted Hughes, The Tiger’s Bones, 1974.

- Source: ICE BofA, as of 30 April 2024. The ICE BofA US Corporate Index has a market value of $8.1trn, which equates to 64% of the global corporate universe, represented by the ICE BofA Global Corporate Index, worth $12.7trn.

- Source: ICE BofA, comparing average coupon rates at 30 April 2024 compared to 31 December 2021.

- Source: JP Morgan, High Grade Credit Fundamentals: 4Q23 Review.

Yields move to 15-year high

Today, the flip side of the negative returns experienced in 2021-2022 is that investors can now access the US IG credit market at all-in yields of 5.8%, levels not seen since 2009.5 Most of the increase, however, has been due to volatility in the risk-free rate, and for investors, usually attracted to credit for the spread that it offers above government bonds, current valuations have presented somewhat of a conundrum.

Underpinning this quandary are the laws of economics, which dictate that rate hiking cycles of the magnitude recently witnessed could lead to a slowdown in activity, an easing in the labor market and potentially even a full-blown recession.

At this phase of the cycle, companies may struggle to cope as lending standards tighten through a combination of spiralling interest costs and declining demand for their products and services, leading to negative operating trends and a pick-up in downgrades to high yield (HY) and bankruptcies.

Credit spreads would typically widen in these periods to reflect the additional risk being felt by the corporate sector above the risk-free rate. But there has been nothing typical about the resilience and continued exuberance of corporate America in response to the current squeeze in conditions, reflected by credit spreads which have continued to surprise investors by grinding tighter.

- Source: ICE BofA, as at 30 April 2024.

Adjusting to a new norm

Although there have been some headline-grabbing pockets of weakness within the US regional banking sector and commercial real estate, which continues to attract concern, US investment-grade company earnings have broadly held up well, despite some notable misses. Overall company profitability6 contracted mildly in 2023, weighed down by the commodity sector, but remains broadly stable, having grown significantly during the post-pandemic years of central bank generosity. The first quarter of 2024 saw solid earnings growth.

Margins within most sectors have also stabilized and even improved for higher-quality issuers after a period of deterioration. Sticky inflation led to increased costs without revenues keeping pace but as inflation moderates, pricing action and efficiency measures undertaken by IG companies in the past two years could drive margin improvement.

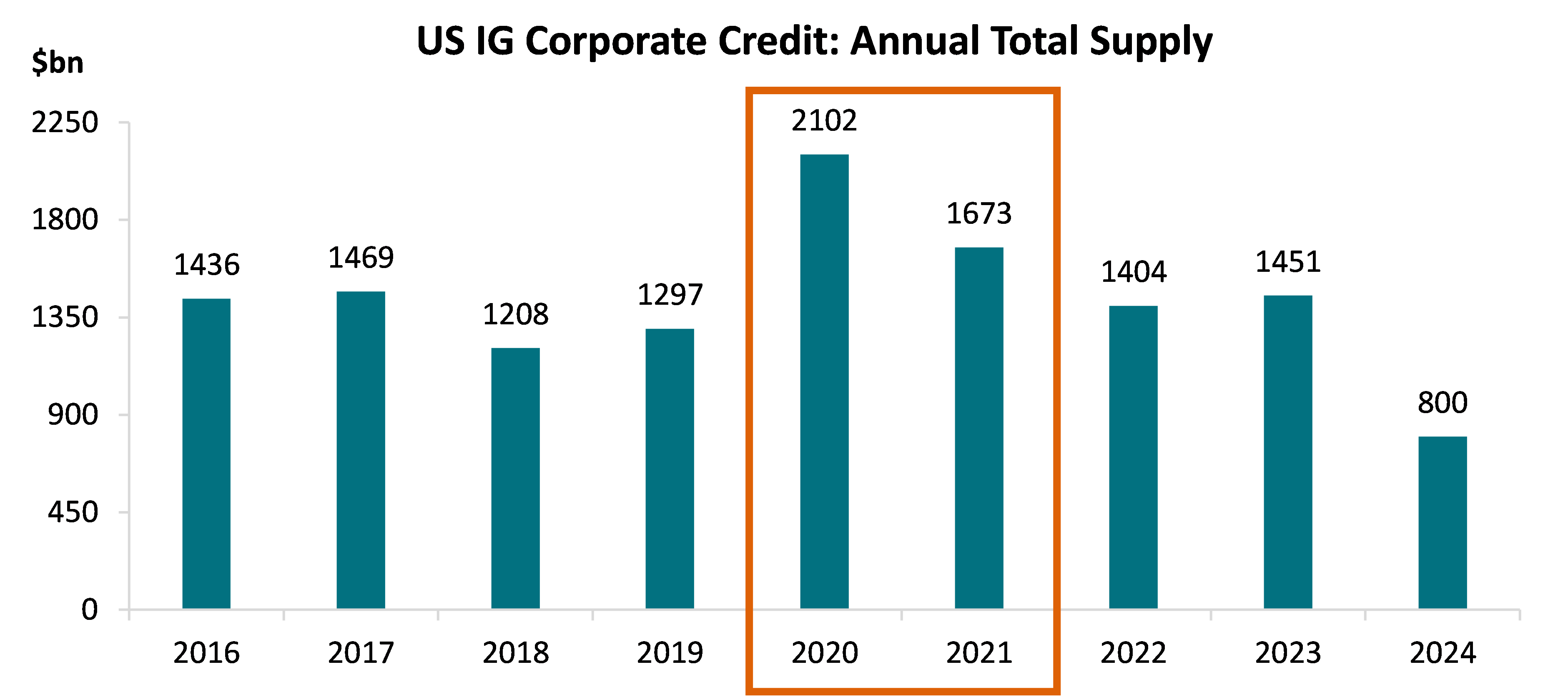

Turning to the primary market, many companies took advantage of very low rates in 2020-2021 to refinance debt and lock in low interest expense costs on long maturity bonds. These two years saw a wave of new issuance totalling $3.8bn of debt across the US IG credit market, – as seen in the graph below –, primarily used for refinancing purposes. This combined total was 51% higher than the previous two-year total of 2018-2019. As a result, comparing the end of 2018 with 2021, the market’s average maturity increased from 10.4 years to 11.8 years – its highest point since 1999.7

Source: Barclays Live Report 30 April 2024

For an asset class like US credit, which has a longer duration than its European counterpart and less callability than HY (meaning more bonds are retired at their original maturity date), the proactivity of companies in adjusting their capital structures while rates were low has afforded them time to adjust to this period of higher rates. The fact the new issue market has remained active even as rates have been going up is testament to the buffer that many companies have to stomach some additional interest expense after the bumper years of 2020-2021. US companies’ large balance sheet cash reserves have helped them manage their debt profiles comfortably.

This can also be attributed to overall leverage remaining at manageable levels, with many companies entering this higher rate period having used the large cash piles built up during 2020-2021 to pay down debt. Now that quantitative easing (QE) is no longer keeping a virtual ceiling on how high yields can go, management teams have the real incentive to keep leverage low so that the overall interest burden today is not so much higher than when rates were low.

Their relative success in doing so is supported by interest coverage ratios, which have deteriorated from a peak in the second half of 2022, given the burden of increased interest expense coupled with mild profitability decline, but not to concerning levels that most IG companies can’t deal with. Overall coverage ratios remain higher today compared to the end of 2019, although disciplined credit selection is warranted to weed out the companies unable to adapt to these shifting currents.

- EBITDA (Earnings before interest, taxes, depreciation and amortisation)

- Source: ICE BofA US Corporate Index, monthly data.

Technical tailwinds

After such a strong run, primary market forecasts are, on average, down for 2024 as companies grapple with higher borrowing costs. That said, there continues to be robust demand for high quality credit, meaning that even as supply in 2024 continues to exceed expectations, the market is not struggling to absorb current volumes. This in turn is providing technical support and playing a significant offsetting role in limiting any impact on spreads from higher rates.

Perhaps the largest form of technical support has been from the strong ratings momentum across the full credit continuum. Last year saw a record upgrade volume in the US IG market of $791bn (11% of market size), which included $101bn of rising stars from HY of which Ford, the largest rising star, accounted for 40%. Downgrades totalled $225bn (3%), of which just $25bn fell to HY. This equated to an upgrade/downgrade ratio of 3.5 times, well above the past 15-year average of 1.1 times.8

Although we expect 2024 to be more balanced in terms of ratings trends, the market is entering this period from strength in terms of credit quality with just 46% in BBBs – the lowest it has been since 2016.9 This is due to a healthy combination of strong momentum in terms of upgrades, as well as limited rating deterioration into the lowest BBB bucket, with just $33bn of the $200bn downgraded (16%) moving from A to BBB.6

At the same time, higher income potential and expectations of a peak in the Fed Funds Rate have driven investors back to high quality credit, with nearly $200bn of inflows into US IG credit in 2023 (split evenly between exchange-traded funds and mutual funds) and continued demand in 2024 as investors look to deploy cash from the high inventories built up over recent years.

This is testament to the power of the yield buyers who, despite tight spreads, are attracted to the potential total return that the asset class could offer.

- Source: JP Morgan, High Grade Credit Ratings Review – 2023 Recap.

- Monthly data for the ICE BofA US Corporate Index.

Dawn after dark

While the fundamental and technical picture looks healthy, the biggest tailwind of all would come from the macro story and Fed cuts, which remain very much on the table for 2024 despite sticky inflation. Fed cuts would initiate a decline in short-term deposit rates and create better entry points for spread buyers. A potential steepening in the yield curve after persistent inversion could also present more opportunities further out along the curve.

Risks remain on both sides, if the economy is weaker or stronger than expected, while the higher-for-longer environment could drive a more pronounced deterioration in interest coverage ratios, which needs to be carefully monitored through active fundamental research.

Meanwhile, the market is starting to look through the current impasse, recognizing that although the price has been high, the potential for attractive total returns from high-quality credit could be back.

Read more on the US

Disclaimer

Este documento ha sido emitido por AXA IM México, S.A. de C.V., (“AXA IM Mexico”) un asesor financiero independiente constituido de conformidad con la Ley del Mercado de Valores. La información aquí contenida es consistente con las disposiciones contenidas en el artículo 6 de la Ley del Mercado de Valores, de conformidad con las disposiciones del Artículo 226, Sección VIII del mismo ordenamiento legal.

Este documento y la información contenida en este documento están diseñados para el uso exclusivo de clientes sofisticados o inversionistas institucionales y/o calificados y no debe ser dirigido hacia clientes minoristas o inversionistas particulares. Ha sido preparado y publicado con fines informativos únicamente a solicitud exclusiva de los destinatarios especificados y no destinado a la circulación general entre el público inversionista. Es estrictamente confidencial y no se debe reproducir, distribuir, circular, redistribuir ni utilizar de otra manera, total o parcialmente, de ninguna manera sin el consentimiento previo por escrito de AXA IM Mexico. No está destinado a ser distribuido a ninguna persona o jurisdicción para la que esté prohibido.

En la medida de lo permitido por la ley, AXA IM Mexico no garantiza la exactitud o idoneidad de cualquier información contenida en este documento y no asume responsabilidad alguna por errores o declaraciones erróneas, ya sea por negligencia o cualquier otra razón. Dicha información puede estar sujeta a cambios sin previo aviso. Los datos contenidos en este documento, incluyendo pero no limitado a cualquier backtesting, historial de desempeño simulado, análisis de escenarios e instrucciones de inversión, se basan en una serie de supuestos e insumos clave y se presentan con fines indicativos y / o ilustrativos solamente.

Este documento ha sido preparado sin tener en cuenta las circunstancias personales específicas, los objetivos de inversión, la situación financiera o las necesidades particulares de persona alguna en particular. Nada de lo contenido en este documento constituirá una oferta para entrar o un término o condición de cualquier negocio, transacción, contrato o acuerdo con el receptor del mismo o con cualquier otra parte. Este documento no se considerará como asesoría en inversión, asesoría fiscal o legal, ni una oferta de venta o solicitud de inversión en un fondo en particular. Si no está seguro del significado de cualquier información contenida en este documento, consulte a su asesor financiero u otro asesor profesional. Los datos, las proyecciones, los pronósticos, las previsiones, las hipótesis y / o las opiniones aquí vertidas son subjetivos y no son necesariamente utilizados o seguidos por AXA IM Mexico o sus compañías afiliadas que pueden actuar basándose en sus propias opiniones y como áreas independientes dentro de la organización.

Toda actividad de inversión conlleva riesgos. Debe tener en cuenta que las inversiones pueden aumentar o disminuir en valor y que el rendimiento pasado no es garantía de rentabilidades futuras, es posible que no reciba la cantidad inicialmente invertida. Los inversores no deben tomar ninguna decisión de inversión basada únicamente en este material.

Si algún fondo se destaca de manera particular en esta comunicación (el "Fondo"), su documento de oferta, prospecto de inversión o documento de información clave contiene información importante sobre restricciones de venta y factores de riesgo, debe leerlos cuidadosamente antes de realizar cualquier transacción. Es su responsabilidad conocer y observar todas las leyes y reglamentos aplicables de cualquier jurisdicción pertinente. AXA IM Mexico no tiene intención de ofrecer ningún Fondo en ningún país donde dicha oferta esté prohibida.

Para conocer la totalidad de los riesgos asociados, lea cuidadosamente el prospecto y/o el folleto de información clave del fondo.

AXA IM México, S.A. de C.V. está inscrita en el Registro Público de Asesores en Inversiones con número de folio 30054-001-(14084)-20/05/2016, asignado por la Comisión Nacional Bancaria y de Valores. Al respecto, la Comisión Nacional Bancaria y de Valores supervisa exclusivamente la prestación de servicios de administración de cartera de valores cuando se tomen decisiones de inversión a nombre y por cuenta de terceros, así como los servicios consistentes en otorgar asesoría de inversión en Valores, análisis y emisión de recomendaciones de inversión de manera individualizada, por lo que dicha Comisión Nacional Bancaria y de Valores carece de atribuciones para supervisar o regular cualquier otro servicio que AXA IM México pueda proporcionar a sus clientes. La inscripción en el Registro Público de Asesores en Inversiones que lleva la Comisión Nacional Bancaria y de Valores en términos de la Ley del Mercado de Valores, no implica el apego de AXA IM México a las disposiciones aplicables en los servicios prestados, ni la exactitud o veracidad de la información proporcionada.

AXA IM México, S.A. de C.V. conforme a la Ley del Mercado de Valores, tiene prohibido garantizar rendimientos a sus clientes sobre sus inversiones, así como recibir en depósito o custodia dinero o valores de sus clientes.

Asimismo, AXA IM México no percibe remuneraciones de parte de emisoras o personas relacionadas por la promoción de valores, ni de intermediarios del mercado de valores, nacionales o del extranjero.