Regional Economic Advantages

- 23 Abril 2024 (3 min read)

1. The continued potential nearshoring presents:

In early 2018, prior to the implementation of Trump's tariffs, China held a significant share of 22% in US imports. However, by February 2024, this share has dwindled to approximately 14%, a significant decline of 8 percentage points. Meanwhile, Mexico has seen its share rise to 15.2% from 13.2%, overtaking China as the US’ main source of goods imports. Looking ahead, sustained geopolitical tensions, especially in the event of Trump's reelection, could exacerbate China's loss of share, potentially enabling Mexico to capitalize further. However, competition remains intense, as other nations—especially those neighboring China, such as Vietnam—have also witnessed a surge due to China's reduced influence.

Yet, even beyond geopolitical dynamics, logistical challenges continue to weigh heavily on American manufacturers. Survey results from the National Association of Manufacturers in the US reveal that concerns related to logistics (see pink bars below) rank among the primary issues for the sector. This contrasts sharply with the situation prior to Trump's election in 2016, where such concerns were absent. Again, Mexico can position itself as answer to these challenges due to its geographical proximity to the US and access to its market through the USMCA trade agreement.

Surveys from the National Association of Manufacturers (NAM), 2016 vs 2023

2. Access to cheap energy from the US:

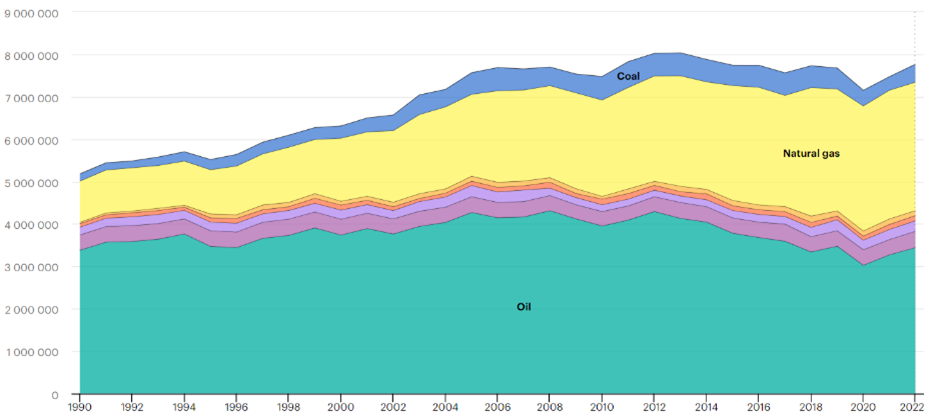

For the past decade, Mexico has consistently consumed more energy than it produces, despite a significant energy reform in 2013. This deficit stems from aging infrastructure, insufficient investment, and an unpredictable energy policy, which could potentially hinder the country's ability to fully benefit from nearshoring opportunities.

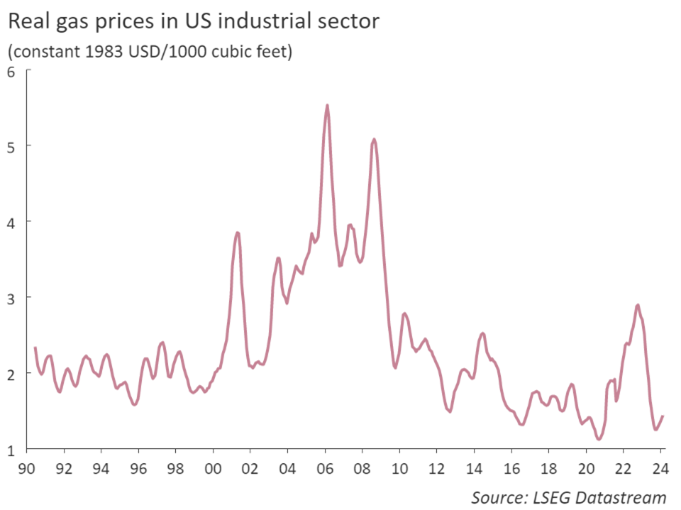

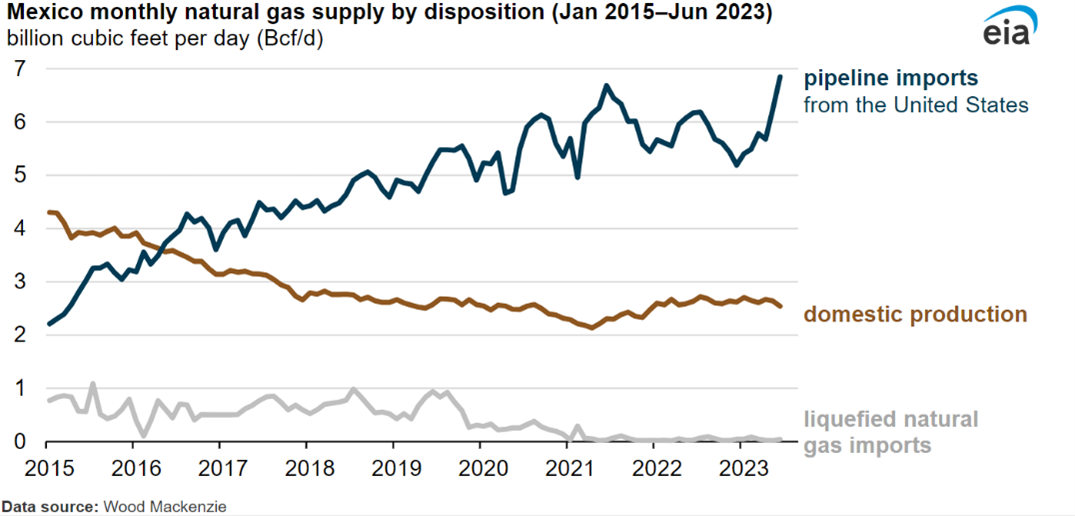

However, Mexico benefits from a network of natural gas pipelines connecting it to the United States, ensuring a reliable and cost-effective energy source. In June 2023, natural gas imports from the US reached record highs. Natural gas now constitutes approximately 40% of Mexico's energy mix. This trend is expected to continue, given that real gas prices in the US are currently hovering around decade lows. Therefore, despite challenges in Mexico's energy sector, they are not likely to significantly hinder nearshoring efforts in the country.

Total energy supply by source in Mexico (Terajoules)

3. Shifting demographics

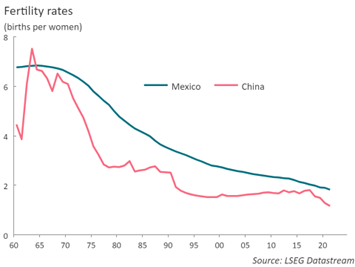

As Mexico and China have evolved from low-income to middle-income countries, their demographic landscapes have undergone significant transformations. Both nations have experienced continuous declines in fertility rates since the 1960s. However, China, having implemented its former one-child policy, has progressed further in this demographic transition, with a fertility rate of 1.1 births per woman (as of 2021), leading to a population decline. In contrast, Mexico's fertility rate stands at 1.8 births per woman.

This disparity in demographics is reflected in the comparison of wages between the two countries. Since 2015, wages in Mexico's manufacturing sector have been consistently lower, enhancing Mexico's competitiveness in labor costs. This advantage is further bolstered by Mexico's lower transportation costs, its reliable access to the US market through the USMCA trade agreement, and its role as an ally of the US. All these factors should help Mexico become a competitive candidate to attract FDI flows not only from American companies, but also Chinese companies looking to bypass tariffs imposed by the US.

Disclaimer

Este documento ha sido emitido por AXA IM México, S.A. de C.V., (“AXA IM Mexico”) un asesor financiero independiente constituido de conformidad con la Ley del Mercado de Valores. La información aquí contenida es consistente con las disposiciones contenidas en el artículo 6 de la Ley del Mercado de Valores, de conformidad con las disposiciones del Artículo 226, Sección VIII del mismo ordenamiento legal.

Este documento y la información contenida en este documento están diseñados para el uso exclusivo de clientes sofisticados o inversionistas institucionales y/o calificados y no debe ser dirigido hacia clientes minoristas o inversionistas particulares. Ha sido preparado y publicado con fines informativos únicamente a solicitud exclusiva de los destinatarios especificados y no destinado a la circulación general entre el público inversionista. Es estrictamente confidencial y no se debe reproducir, distribuir, circular, redistribuir ni utilizar de otra manera, total o parcialmente, de ninguna manera sin el consentimiento previo por escrito de AXA IM Mexico. No está destinado a ser distribuido a ninguna persona o jurisdicción para la que esté prohibido.

En la medida de lo permitido por la ley, AXA IM Mexico no garantiza la exactitud o idoneidad de cualquier información contenida en este documento y no asume responsabilidad alguna por errores o declaraciones erróneas, ya sea por negligencia o cualquier otra razón. Dicha información puede estar sujeta a cambios sin previo aviso. Los datos contenidos en este documento, incluyendo pero no limitado a cualquier backtesting, historial de desempeño simulado, análisis de escenarios e instrucciones de inversión, se basan en una serie de supuestos e insumos clave y se presentan con fines indicativos y / o ilustrativos solamente.

Este documento ha sido preparado sin tener en cuenta las circunstancias personales específicas, los objetivos de inversión, la situación financiera o las necesidades particulares de persona alguna en particular. Nada de lo contenido en este documento constituirá una oferta para entrar o un término o condición de cualquier negocio, transacción, contrato o acuerdo con el receptor del mismo o con cualquier otra parte. Este documento no se considerará como asesoría en inversión, asesoría fiscal o legal, ni una oferta de venta o solicitud de inversión en un fondo en particular. Si no está seguro del significado de cualquier información contenida en este documento, consulte a su asesor financiero u otro asesor profesional. Los datos, las proyecciones, los pronósticos, las previsiones, las hipótesis y / o las opiniones aquí vertidas son subjetivos y no son necesariamente utilizados o seguidos por AXA IM Mexico o sus compañías afiliadas que pueden actuar basándose en sus propias opiniones y como áreas independientes dentro de la organización.

Toda actividad de inversión conlleva riesgos. Debe tener en cuenta que las inversiones pueden aumentar o disminuir en valor y que el rendimiento pasado no es garantía de rentabilidades futuras, es posible que no reciba la cantidad inicialmente invertida. Los inversores no deben tomar ninguna decisión de inversión basada únicamente en este material.

Si algún fondo se destaca de manera particular en esta comunicación (el "Fondo"), su documento de oferta, prospecto de inversión o documento de información clave contiene información importante sobre restricciones de venta y factores de riesgo, debe leerlos cuidadosamente antes de realizar cualquier transacción. Es su responsabilidad conocer y observar todas las leyes y reglamentos aplicables de cualquier jurisdicción pertinente. AXA IM Mexico no tiene intención de ofrecer ningún Fondo en ningún país donde dicha oferta esté prohibida.

Para conocer la totalidad de los riesgos asociados, lea cuidadosamente el prospecto y/o el folleto de información clave del fondo.

AXA IM México, S.A. de C.V. está inscrita en el Registro Público de Asesores en Inversiones con número de folio 30054-001-(14084)-20/05/2016, asignado por la Comisión Nacional Bancaria y de Valores. Al respecto, la Comisión Nacional Bancaria y de Valores supervisa exclusivamente la prestación de servicios de administración de cartera de valores cuando se tomen decisiones de inversión a nombre y por cuenta de terceros, así como los servicios consistentes en otorgar asesoría de inversión en Valores, análisis y emisión de recomendaciones de inversión de manera individualizada, por lo que dicha Comisión Nacional Bancaria y de Valores carece de atribuciones para supervisar o regular cualquier otro servicio que AXA IM México pueda proporcionar a sus clientes. La inscripción en el Registro Público de Asesores en Inversiones que lleva la Comisión Nacional Bancaria y de Valores en términos de la Ley del Mercado de Valores, no implica el apego de AXA IM México a las disposiciones aplicables en los servicios prestados, ni la exactitud o veracidad de la información proporcionada.

AXA IM México, S.A. de C.V conforme a la Ley del Mercado de Valores, tiene prohibido garantizar rendimientos a sus clientes sobre sus inversiones, así como recibir en depósito o custodia dinero o valores de sus clientes.

Asimismo, AXA IM México no percibe remuneraciones de parte de emisoras o personas relacionadas por la promoción de valores, ni de intermediarios del mercado de valores, nacionales o del extranjero.