Reflecting climate-related goals in an ETF portfolio

- 17 Abril 2024 (3 min read)

KEY POINTS

For ETF investors looking to reflect the climate-related goals in their portfolios, funds that follow indexes such as the Paris-Aligned Benchmark offer a potential solution.

Identifying ETFs that can demonstrate carbon emission criteria clearly has not been a straightforward task. While benchmarks exist for comparing impact portfolios, such as green and social bonds, it has been challenging to find a reference point for a conventional portfolio designed to support the transition to a low carbon economy.

This is where benchmarks, such as the Paris-Aligned benchmarks (PABs) and the Climate Transition benchmarks (CTBs), can offer an option for investors. These benchmarks assess companies’ contributions to the transition to a low-carbon economy. While both PAB and CTB share a similar focus on decarbonization with an annual 7% target on carbon reduction, there are key differences between the two:

- The PAB aims to achieve alignment with the 1.5°C goal of the Paris Agreement, which excludes fossil-fuel intensive companies.

- The CTBs focus on transitioning to a low-carbon economy rather than just limiting global warming.

- The PAB requires a more aggressive 50% minimum carbon reduction relative to the market index, as compared to the 30% reduction required for the CTB approach.

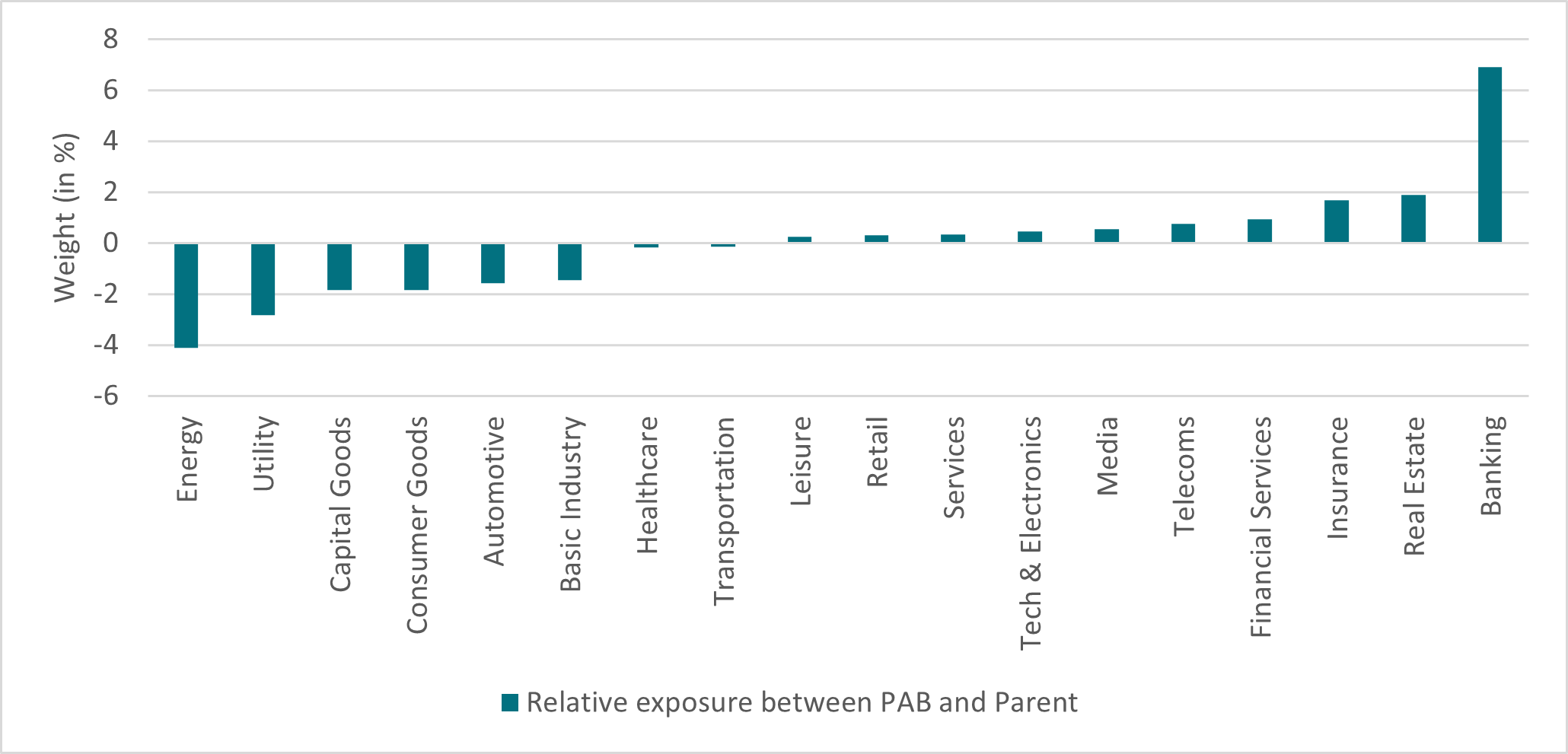

The PAB is designed to align with climate goals, typically emphasising sectors and issuers that contribute positively to decarbonization efforts. Therefore, it has a slightly higher weighting to lower carbon intensity sectors such as Banks, Insurance, Real Estate, and Telecoms. On the other hand, it has less exposure than its parent index to other sectors that are highly carbon intensive such as Energy, Utilities and Basic Industry.

This approach goes beyond blanket exclusions, and instead focuses on positive screening. In doing so, the benchmark aims to fund the transition to a sustainable economy, while encouraging issuers in more pollutant sectors to develop more sustainable practises.

Nevertheless, as the chart below demonstrates, the sector weighting differences between the PAB and its parent index remains limited.

Sector relative exposure

Source: AXA-IM, Bloomberg, as of 25/03/2024. Indices compared: Parent: ICE BofA Euro Corporate Index and PAB: ICE BofA Euro Corporate Index Paris Aligned (Absolute Emissions)

Is there a trade-off for a climate aware approach?

The role of a climate index is to closely track its parent index while sifting issuers that don’t meet the emission requirements. Therefore, the climate index will have less issues than its parent index, although it still maintains sufficient diversity and liquidity.

Historically, funds looking to reflect decarbonization in their portfolios would use a standard benchmark and then exclude certain sectors. This led to higher tracking errors because the exclusions meant a more concentrated portfolio. Being able to use a benchmark specifically designed to reflect companies that are contributing towards the decarbonization should mean that the fund’s tracking error is much lower.

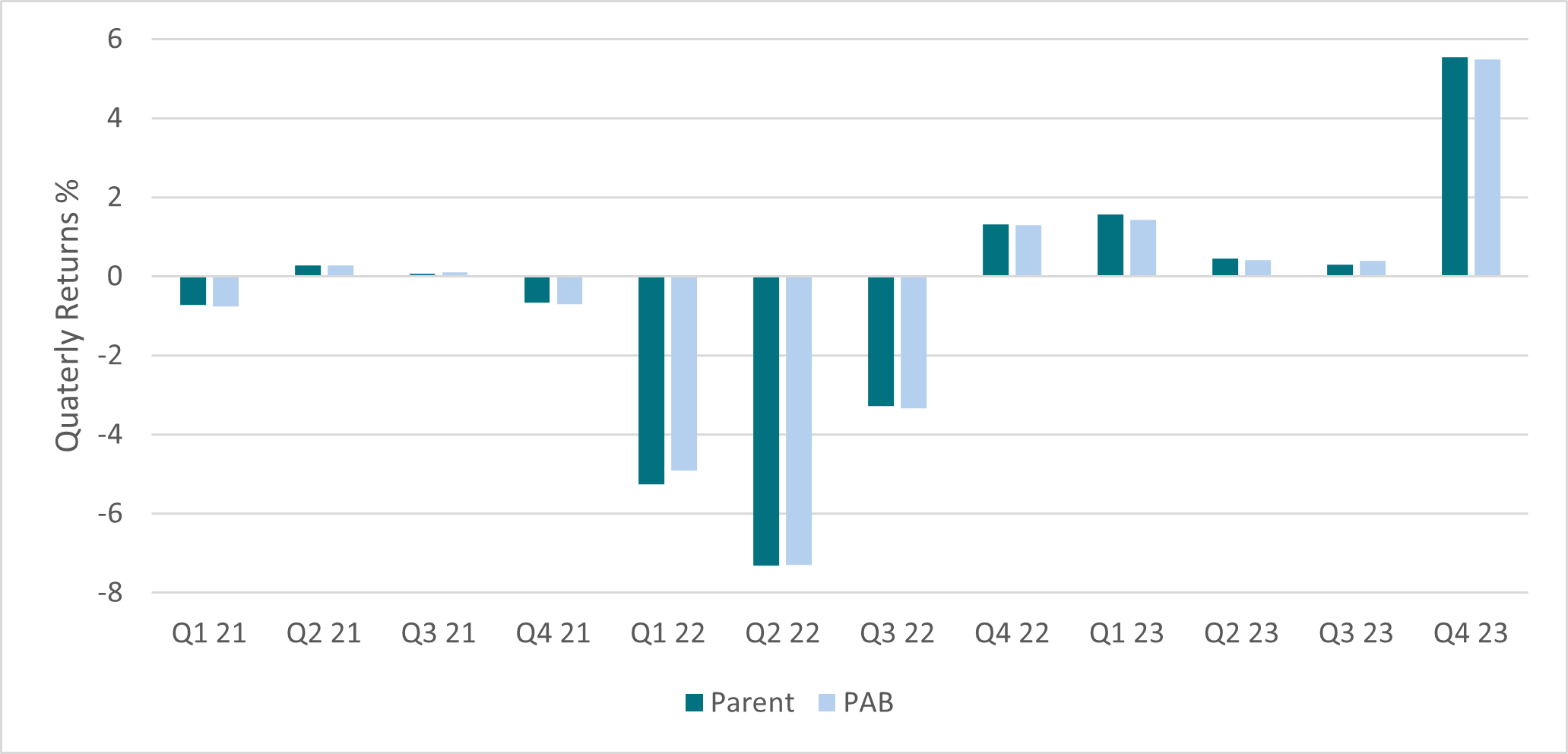

When comparing the ICE BofA Euro Credit Paris Aligned (Absolute Emissions) index with its parent index, they both have similar credit risk profiles with each currently offering an average credit rating of A-1 .

Furthermore, the performance in 2021, 2022 and 2023 was relatively closely correlated. While the data is still limited for comparison given that the PAB was only launched in 2021, these initial years demonstrate that it is possible to not give up returns for sustainable investing, as illustrated in the chart below:

Return for Parent and PAB indices

Source: AXA-IM, Bloomberg, as of 25/03/2024. Indices compared: Parent: ICE BofA Euro Corporate Index and PAB: ICE BofA Euro Corporate Index Paris Aligned (Absolute Emissions)

Indexes, like PAB and CTB, offer investors a solution that allows them to reflect their climate-related goals without having to accept a higher tracking error or more concentrated portfolio.

- U291cmNlOiBBWEEgSU0sIEJsb29tYmVyZyBhcyBvZiAwMyBBcHJpbCAyMDI0

Disclaimer

Este documento ha sido emitido por AXA IM México, Asesores en Inversiones Independientes, SA de CV, (“AXA IM Mexico”) un asesor financiero independiente constituido de conformidad con la Ley del Mercado de Valores. La información aquí contenida es consistente con las disposiciones contenidas en el artículo 6 de la Ley del Mercado de Valores, de conformidad con las disposiciones del Artículo 226, Sección VIII del mismo ordenamiento legal.

Este documento y la información contenida en este documento están diseñados para el uso exclusivo de clientes sofisticados o inversionistas institucionales y/o calificados y no debe ser dirigido hacia clientes minoristas o inversionistas particulares. Ha sido preparado y publicado con fines informativos únicamente a solicitud exclusiva de los destinatarios especificados y no destinado a la circulación general entre el público inversionista. Es estrictamente confidencial y no se debe reproducir, distribuir, circular, redistribuir ni utilizar de otra manera, total o parcialmente, de ninguna manera sin el consentimiento previo por escrito de AXA IM Mexico. No está destinado a ser distribuido a ninguna persona o jurisdicción para la que esté prohibido.

En la medida de lo permitido por la ley, AXA IM Mexico no garantiza la exactitud o idoneidad de cualquier información contenida en este documento y no asume responsabilidad alguna por errores o declaraciones erróneas, ya sea por negligencia o cualquier otra razón. Dicha información puede estar sujeta a cambios sin previo aviso. Los datos contenidos en este documento, incluyendo pero no limitado a cualquier backtesting, historial de desempeño simulado, análisis de escenarios e instrucciones de inversión, se basan en una serie de supuestos e insumos clave y se presentan con fines indicativos y / o ilustrativos solamente.

Este documento ha sido preparado sin tener en cuenta las circunstancias personales específicas, los objetivos de inversión, la situación financiera o las necesidades particulares de persona alguna en particular. Nada de lo contenido en este documento constituirá una oferta para entrar o un término o condición de cualquier negocio, transacción, contrato o acuerdo con el receptor del mismo o con cualquier otra parte. Este documento no se considerará como asesoría en inversión, asesoría fiscal o legal, ni una oferta de venta o solicitud de inversión en un fondo en particular. Si no está seguro del significado de cualquier información contenida en este documento, consulte a su asesor financiero u otro asesor profesional. Los datos, las proyecciones, los pronósticos, las previsiones, las hipótesis y / o las opiniones aquí vertidas son subjetivos y no son necesariamente utilizados o seguidos por AXA IM Mexico o sus compañías afiliadas que pueden actuar basándose en sus propias opiniones y como áreas independientes dentro de la organización.

Toda actividad de inversión conlleva riesgos. Debe tener en cuenta que las inversiones pueden aumentar o disminuir en valor y que el rendimiento pasado no es garantía de rentabilidades futuras, es posible que no reciba la cantidad inicialmente invertida. Los inversores no deben tomar ninguna decisión de inversión basada únicamente en este material.

Si algún fondo se destaca de manera particular en esta comunicación (el "Fondo"), su documento de oferta, prospecto de inversión o documento de información clave contiene información importante sobre restricciones de venta y factores de riesgo, debe leerlos cuidadosamente antes de realizar cualquier transacción. Es su responsabilidad conocer y observar todas las leyes y reglamentos aplicables de cualquier jurisdicción pertinente. AXA IM Mexico no tiene intención de ofrecer ningún Fondo en ningún país donde dicha oferta esté prohibida.

Para conocer la totalidad de los riesgos asociados, lea cuidadosamente el prospecto y/o el folleto de información clave del fondo.

AXA IM México, Asesores en Inversiones Independientes S.A. de C.V. está inscrita en el Registro Público de Asesores en Inversiones con número de folio 30054-001-(14084)-20/05/2016, asignado por la Comisión Nacional Bancaria y de Valores. Al respecto, la Comisión Nacional Bancaria y de Valores supervisa exclusivamente la prestación de servicios de administración de cartera de valores cuando se tomen decisiones de inversión a nombre y por cuenta de terceros, así como los servicios consistentes en otorgar asesoría de inversión en Valores, análisis y emisión de recomendaciones de inversión de manera individualizada, por lo que dicha Comisión Nacional Bancaria y de Valores carece de atribuciones para supervisar o regular cualquier otro servicio que AXA IM México pueda proporcionar a sus clientes. La inscripción en el Registro Público de Asesores en Inversiones que lleva la Comisión Nacional Bancaria y de Valores en términos de la Ley del Mercado de Valores, no implica el apego de AXA IM México a las disposiciones aplicables en los servicios prestados, ni la exactitud o veracidad de la información proporcionada.

AXA IM México Asesores en Inversiones Independientes, S.A. de C.V conforme a la Ley del Mercado de Valores, tiene prohibido garantizar rendimientos a sus clientes sobre sus inversiones, así como recibir en depósito o custodia dinero o valores de sus clientes.

Asimismo, AXA IM México no percibe remuneraciones de parte de emisoras o personas relacionadas por la promoción de valores, ni de intermediarios del mercado de valores, nacionales o del extranjero.